The dashboard is made up of a number interactive, informational widgets. Below you will find a description of each widget.

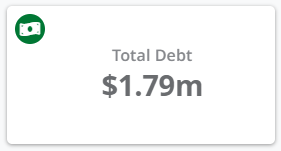

Total Debt

Displays the total amount of money owed to the company by your customers, including not yet due, overdue, disputed and non-allocated.

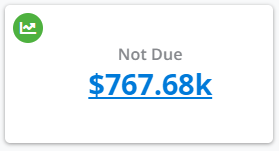

Not Due

This is the total amount of money owed to the company but is not yet due. This is made up of invoices not yet paid but still within their payment terms (30 days etc.)

You can click on the value to drill down into the Invoices List to see all invoices that are not due.

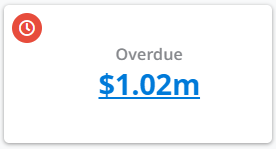

Overdue

The total amount of money owed and is now overdue. This is made up of customers who are late in paying their invoices.

You can click on the value to drill down into the Invoices List to see all invoices that are overdue.

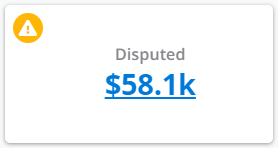

Disputed

The amount of money from invoices that have been marked as disputed. A disputed invoice can still be overdue or not due but will be included in this figure due to being disputed.

You can click on the value to drill down into the Invoices List to see all invoices that are disputed.

Non Allocated

This is the total amount of payments that have been received from customers but not yet allocated to invoices. Use your accounting software to allocate any payments that are for outstanding invoices.

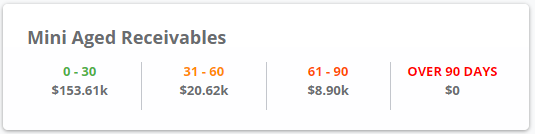

Mini Aged Receivables

Mini Aged Receivables widget

Mini Aged Receivables widget

This widget displays the balance of money owed to you by your customers, broken down by aged buckets. Clicking on any section will open up a list, showing you the customers who make up that particular total. You can read more in Aged Receivables / Aged Debt.

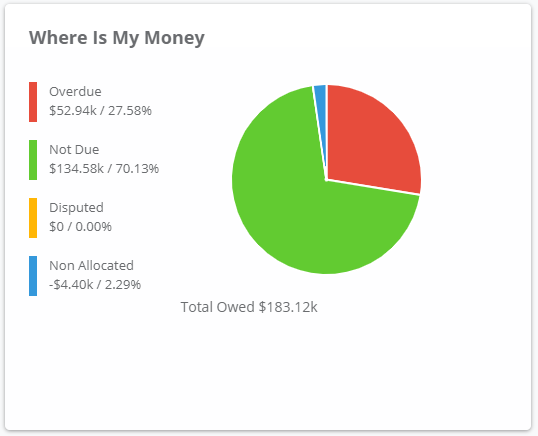

Where is My Money

Where is My Money widgetThis widget shows all of the money currently owed to you as a pie-chart, and is broken-down by:

Where is My Money widgetThis widget shows all of the money currently owed to you as a pie-chart, and is broken-down by:

| Overdue | Money that should have been paid to you and is late. Credit Hound can be configured to chase for these overdue payments automatically using Collection Paths |

| Not Due | Money from invoices that haven not been paid but are still within their payment terms (e.g. 30 days, 14 days etc.) and therefore not yet due |

| Disputed | The total amount of money from invoices that are marked as disputed. You can put and invoice on and off dispute in the Customer Screen |

| Non Allocated | This is the total amount of payments that have been made but not yet allocated to an invoice |

Clicking on a segment of the pie or the key title, will open up a screen detailing the customers who make up that section of the chart. See Customer List for more information.

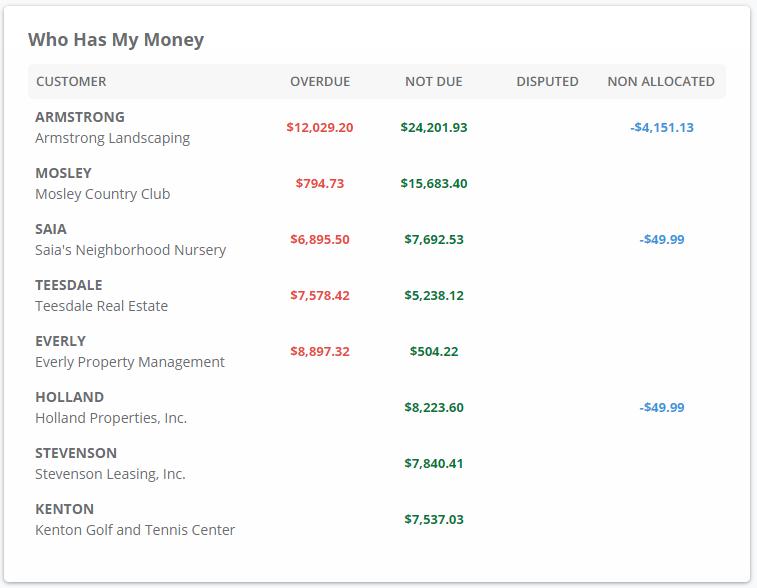

Who Has My Money

Who Has My Money widget

Who Has My Money widget

The Who Has My Money widget shows you the top 8 customers who owe you the most money. Clicking a row will open up the customers details .

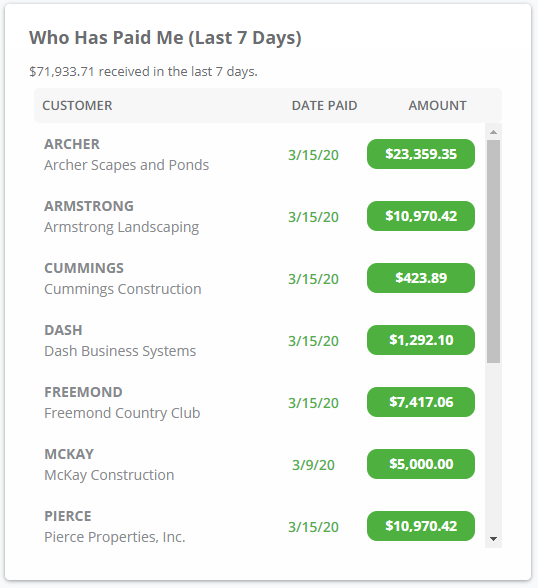

Who Has Paid Me

Who Has Paid Me

Who Has Paid Me

This is a list of customers who have paid in the last 7 days, when they paid and how much they paid. Clicking a row will open up the customers details.

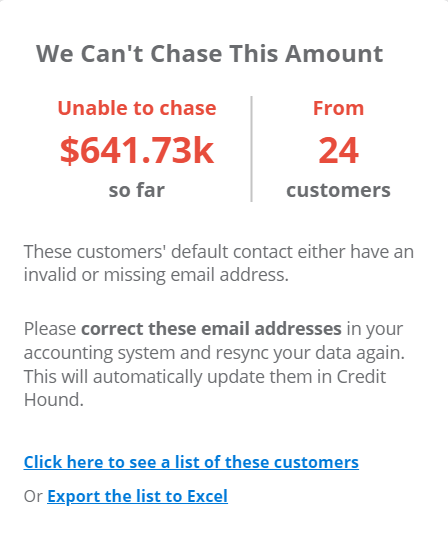

Customer Email Issues

Customer Email Issues Widget

Customer Email Issues WidgetThis widget displays a count of all customers who either do not have an email address on their default contact, or the email address is invalid. These customer cannot be automatically chased by Credit Hound until the email addresses are added or corrected. The Unable to chase figure is the total amount of money that cannot be chased automatically.

Click on the 'Click here to see a list of these customers' link to take you to the List of Customer Email Issues. This shows all the customers affected and to correct in your accounting system,

Data in the widget can be exported to an Excel file. Click the Export the list to Excel link. The exported file will contain the data that is displayed in the widget which allows you to easily see a list of all customers that have invalid email addresses. The file will be downloaded to your browsers download folder.