Analysis Codes allow you to bring additional customer-level information from your accounting system into Credit Hound Cloud . These fields can then be displayed, sorted, and filtered to help segment customers and create targeted Collection Paths.

Analysis Codes in Credit Hound Cloud are read-only and reflect the values stored in your accounting system.

What Data Can Be Synchronised as Analysis Codes?

Standard Sage Intacct Customer Fields

Credit Hound Cloud supports the following standard Sage Intacct fields:

| Credit Hound Cloud Name | Sage Intacct Field |

| Territory | Territory ID |

| Sales Representative | Sales Rep |

| Customer Type | Type ID |

| GL Group | GL Group |

| Payment Term | Term |

These appear on the Additional Information tab in the Sage Intacct Customer screen.

Customer Custom Fields

You can also sync Sage Intacct Custom Fields created at the Customer object level (in Sage Intacct -> Platform Services -> Custom Fields).

These fields appear in the Credit Hound Cloud's available analysis codes under the name defined in Intacct.

Configuring Analysis Codes

This area allows you to configure Analysis Codes and synchronise analysis code values into Credit Hound Cloud.

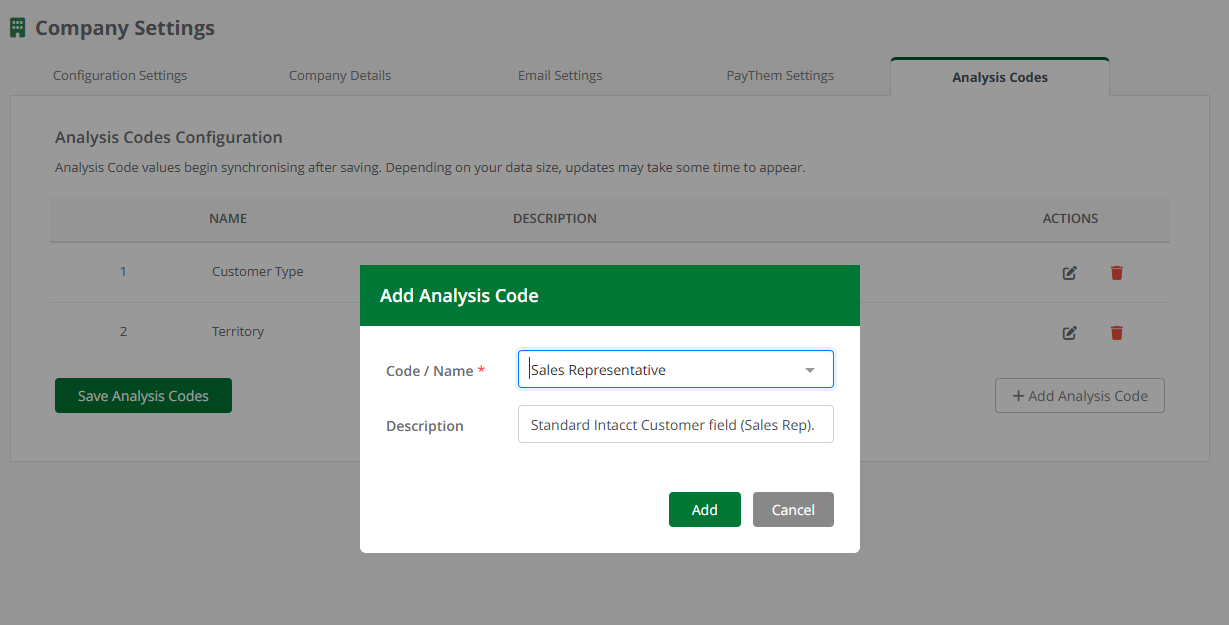

Add Analysis Code

Add Analysis Code- Go to Company Settings.

- Open the Analysis Codes tab.

- Click on the Add Analysis Codes button.

- From the dialog select a Code / Name from the dropdown list. These are synchronised from Sage Intacct and include:

- Standard Intacct Customer fields

- Customer-level Intacct Custom Fields

- (Optional) Enter a description

- Click Add

- Repeat for each Analysis Code you want to sync.

- Once you have added your Analysis Codes, click on the Save Analysis Codes button

Depending on your dataset size, updates may take several minutes to appear across the Customer and Aged Receivables lists.

Editing or Removing Analysis Codes

- Use the icon to edit the name or description.

- Use the icon to remove an Analysis Code.

- Changes take effect after saving and synchronising.

Configuration Columns

| Column Name | Description |

| Name | The name of the Analysis Code, pulled from Sage Intacct. This comes directly from Intacct so cannot be changed. |

| Description | An optional description. If you have a description set against your custom field, then this will be pulled from Sage Intacct. |

| Actions | Here you can click the buttons to Edit or Remove a configured Analysis Code. |

Using Analysis Codes

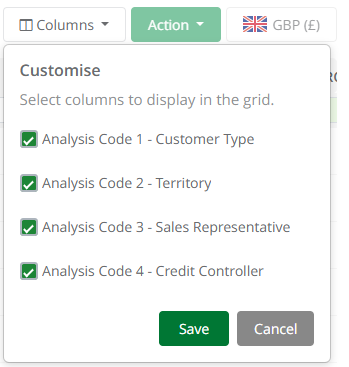

Analysis Codes appear in the Customer List and Aged Receivables List and can be used to enhance filtering, segmentation, and customer management. Use the Columns button to add the configured Analysis Code columns to the lists.

Add Columns

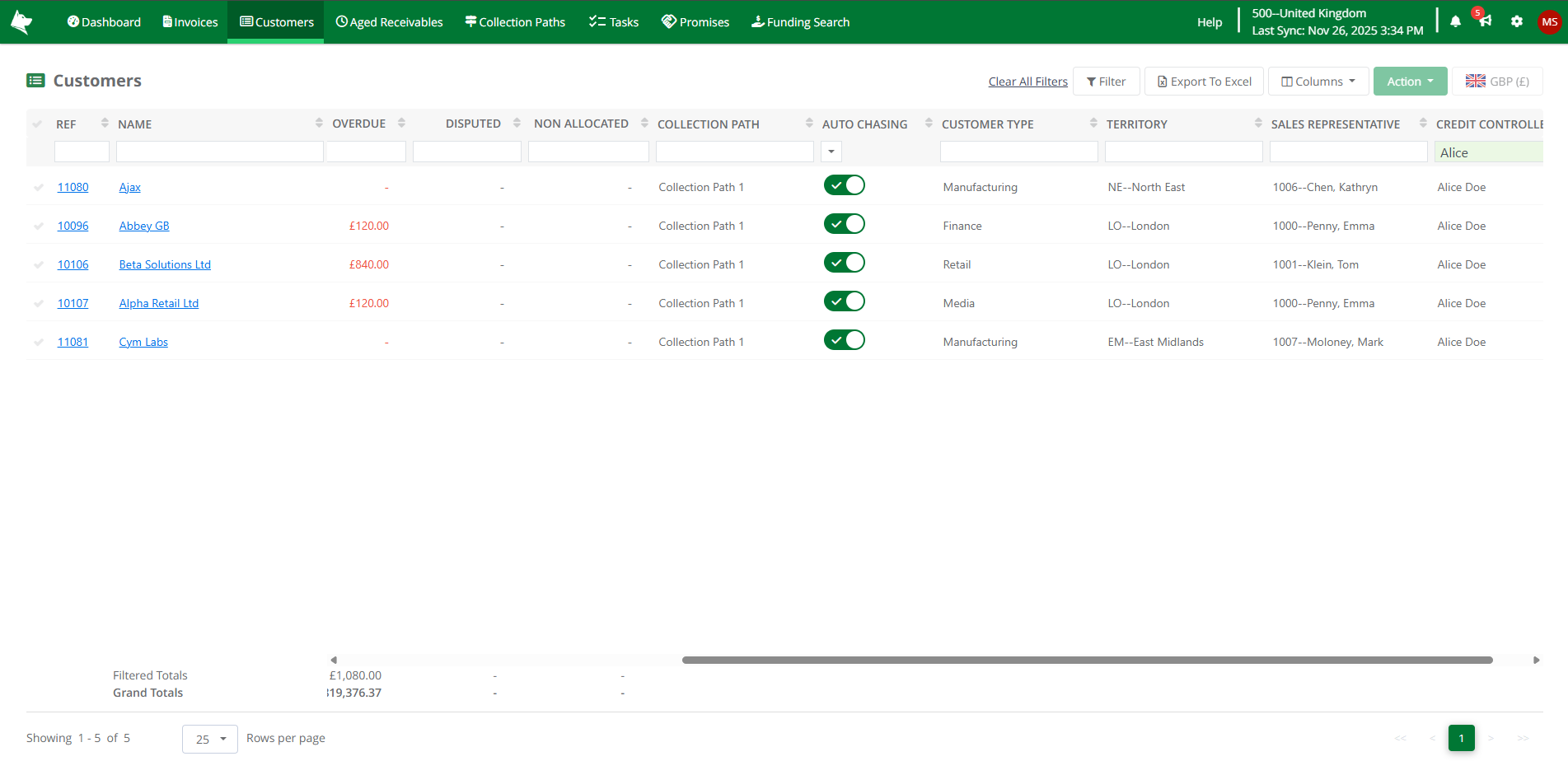

Add Columns Customer List

Analysis Codes can be added as columns to the Customer List.

Customer List - Analysis Codes

Customer List - Analysis Codes- Columns can be shown or hidden using the Columns button.

- Supports sorting and filtering

- Helps you segment customers before assigning Collection Paths.

- The data can be exported to Excel for offline reporting or analysis.

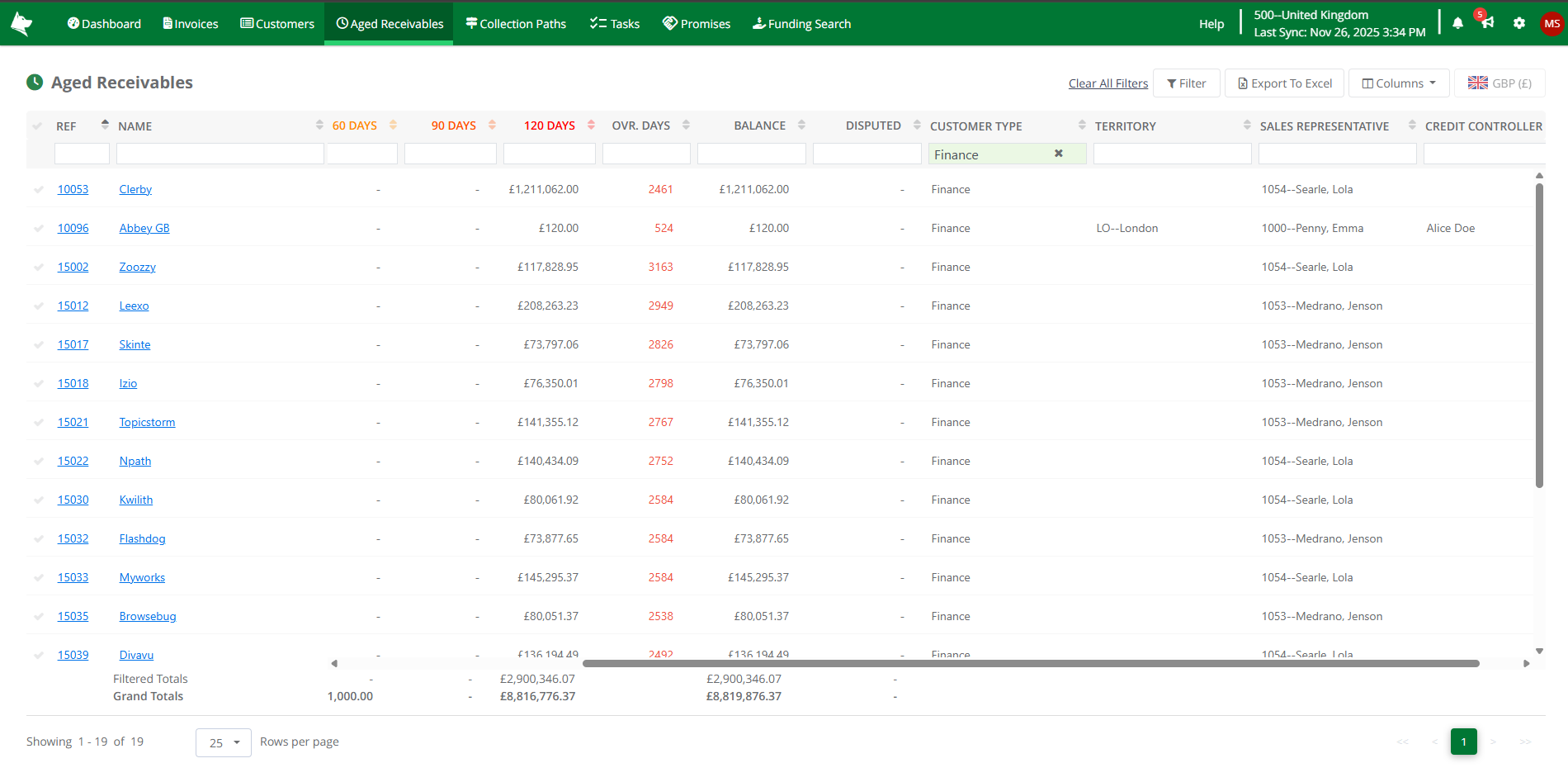

Aged Receivables List

Analysis Codes can also be added to the Aged Receivables List.

Aged Receivables List - Analysis Codes

Aged Receivables List - Analysis Codes

- Columns can be shown or hidden using the Columns button.

- Provides additional context when reviewing overdue accounts.

- Enables filtering for more targeted credit control activity.

- The data can be exported to Excel for further analysis.

Analysis Codes make it easier to organise and prioritise your credit control activities. Common uses include:

- Bulk-assign Customers to Collection Paths

- Filter customers in the Customer List by an Analysis Code (e.g., Customer Type or Territory), then apply a Collection Path to all selected customers at once.

- Filter by Territory for regional chasing

- Ideal for teams where collectors are assigned to specific regions.

- Identify customers with specific Payment Terms

- Example: Focus your chasing efforts on customers with overdue Net 30 terms.

These examples illustrate how Analysis Codes can streamline segmentation and improve the efficiency of your credit control process.