You can purchase a Credit Report, Powered by Experian data, on any given limited company on demand. The data within the Credit Report offers insights into your customer's financial standing and any potential risks they may present. It's prudent to conduct comprehensive credit assessments on customers prior to granting them substantial trade credit and safeguard your business interests.

Purchase a Credit Report

- Open up the Customer

- Click on Get Credit Report

- Review the details and if you are happy, click on Search for report

- Credit Hound Cloud will check with Experian data to see if a matching report can be found for the Customer

- Select the company from the possible matches

- If no match could be found, or you didn't find what you were looking for, you can use the Advanced Search to find the company by clicking on the blue link.

- Click on Proceed to Payment

- You will be redirected to our secure payment page

- Follow the steps to provide your billing details and card information and click Pay to purchase the Credit Report

- You will be redirected back to Credit Hound Cloud and can view the Credit Report from the View Purchased Reports drop down

Sections of Credit Report

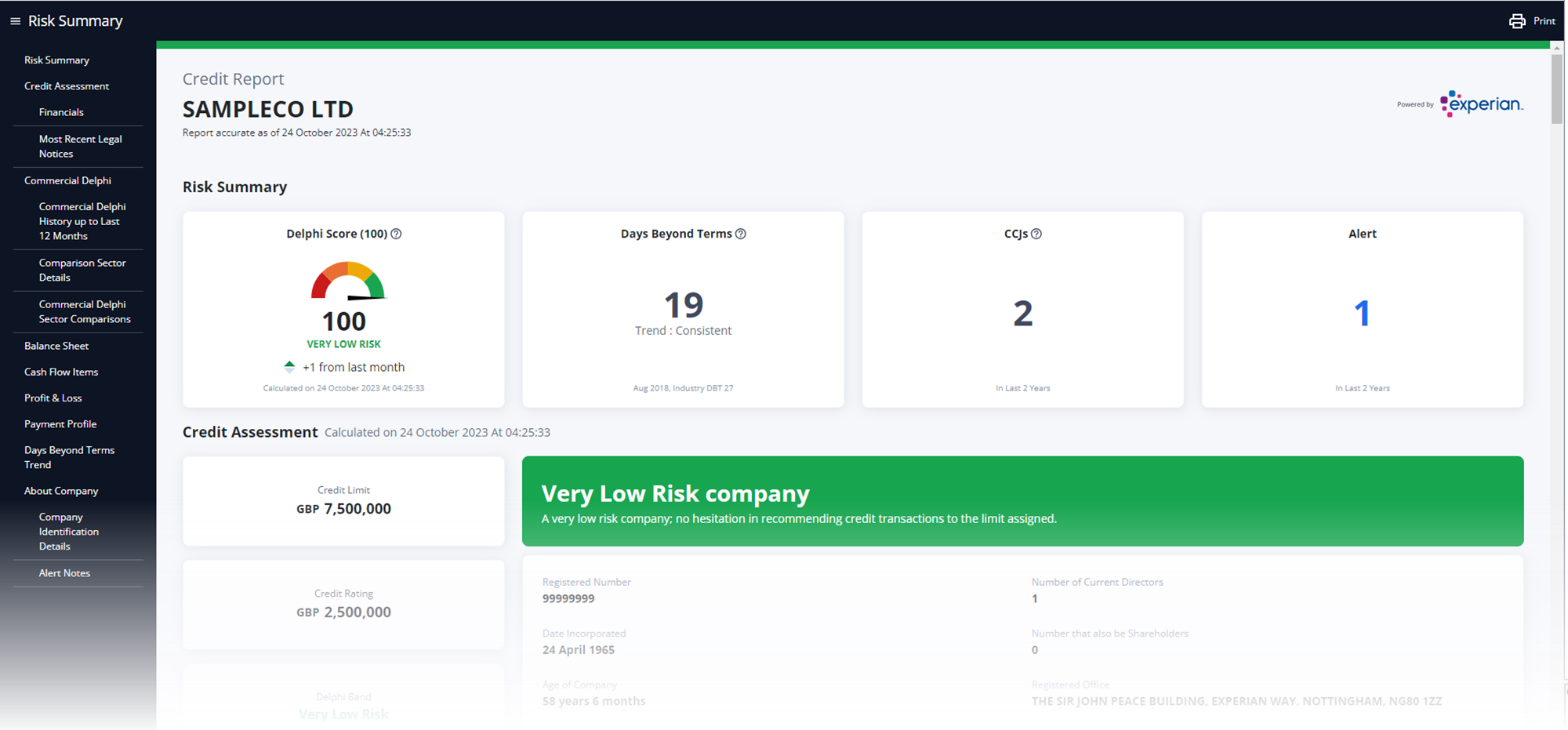

Risk Summary

Delphi Score

Experian's Commercial Delphi Score provides a predictive indication of a company's likelihood of defaulting on payments or entering insolvency within the next year. It evaluates credit risk and the likelihood of business failure in the upcoming year based on a company's financial health. Factors influencing the score include:

- Financial outcomes

- County court judgments for the business and its directors

- Directors' commercial history

- Delays in financial statement filings

- Recent spikes in credit application searches.

It's a composite score based on various financial metrics, payment histories, and external market data. A higher Delphi Score indicates a lower risk of default and vice versa.

Scores range from 0 to 100; with lower scores signifying higher risk. Scores of 0 mark dissolved or failed companies, while a score of 1 points to companies facing dissolution, liquidation, or intending such actions.

Days Beyond Terms (DBT)

Days Beyond Terms (DBT) represents the average number of days a company pays invoices past their agreed-upon payment terms. For instance, if a company consistently pays invoices 10 days after the agreed 30-day term, their DBT would be 10. A higher DBT can be a warning sign of cash flow issues or potential financial distress. This metric is a standard tool for monitoring late payments in business credit.

CCJs (County Court Judgments)

A County Court Judgment is a type of court order in the UK that might be registered against a company if they fail to repay money they owe. The presence of multiple CCJs or large amounts can be a strong indicator of financial distress or mismanagement.

Alerts

Alerts is a count of significant changes or events related to the company, such as changes in directors, alterations in credit scores, or issuance of new CCJs. Regularly monitoring alerts can help you stay updated on a company's financial health and respond proactively to any emerging risks.

Credit Assessment

| Credit Assessment Item | Description |

| Credit Limit | Represents the maximum recommended amount of credit to be extended to a company based on its financial health and creditworthiness. This limit helps businesses decide how much credit or financing they can safely offer to the company. |

| Credit Rating | Based on the Delphi score and the business's size, Experian provides a Credit Rating. This rating reflects the average credit a business might need from a supplier over a 30-day trading span. The credit amount can range from a maximum of £10m down to a minimum of £500 (above £0). |

| Delphi Band | An indicator that classifies companies based on the likelihood of defaulting within a certain timeframe. Experian grouped Delphi Scores into various bands, with each band representing a specific range of risk.

|

| Failure odds | Represents the statistical probability of a company going into insolvency or failing within next 12 months. It provides a numerical insight into the potential financial distress of a company. Represented in ratios, a 1:1 value suggests a 50% risk of failure, whereas 7:1 signifies a 12.5% risk (1 out of 8). Simply put, the shorter the ratio odds, the greater risk of business failure. |

| Risk Band | A classification that groups companies based on their overall risk profile. This banding system considers various financial and non-financial factors, allowing businesses to quickly gauge the risk level associated with a company. |

Financials

The financials section provides an overview of a company's monetary health. It offers detailed insights into key financial metrics such as turnover, profit margins, assets, working capital and shareholder funds Reviewing this data will give you a clear picture of the company's financial strength and stability, allowing for informed business decisions.

Most Recent Legal Notices

Legal notices are critical indicators of a company's legal standing and potential issues. The Most Recent Legal Notices section highlights any new legal actions or proceedings involving the company. This can include anything from litigation to regulatory actions. Keeping an eye on this section can help you spot red flags or potential risks associated with a company's legal status.

Commercial Delphi

Commercial Delphi History up to Last 12 Months

The Commercial Delphi History provides a retrospective view of a company's financial risk over the past year. This section showcases a month-by-month breakdown, revealing trends or shifts in the company's financial stability. Alongside this, the chart shows the the Credit Limit and Credit Rating trends over the last 12 months. By analysing this history, you can understand the company's financial trajectory.

Comparison Sector Details

Understanding a company's financial standing in isolation might not give the full picture. The Comparison Sector Details section offers context by benchmarking the company against others in its sector. This provides insights into how the company stacks up against other companies in terms of financial stability, risk, and other key metrics. You can see the figures for All Scored Companies, Same Industry Group, Same Asset Size Group and Same Age Group. This comparative view helps in gauging the company's position within its industry landscape.

Balance Sheet

The Balance Sheet is a snapshot of a company's financial position at a specific point in time. It outlines the company's assets, liabilities, and equity. It helps provide insights into the company's liquidity, financial flexibility, and overall financial health.

Cash Flow Items

Cash Flow Items gives a clear picture of how money moves in and out of a company. This section breaks down the sources and uses of cash, from operating activities to investments and financing. This provides a deeper understanding of the company's ability to generate positive cash flow and meet its financial obligations.

Profit & Loss

The Profit & Loss section offers a snapshot of a company's financial performance over a certain period. It details revenues, costs, and expenses, revealing the company's operational efficiency and profitability. It helps assess a company's profitability, understanding cost structures, and making informed financial decisions. Regularly reviewing the P&L statement is important for analysing a company’s ability to generate income and manage expenses.

Payment Profile

The Payment Profile section shows the company's history regarding its invoice payments. It reveals patterns in timely payments, delays, or defaults. This profile is crucial because consistent delays or missed payments can be a sign of financial distress or poor money management.

Days Beyond Terms Trend

Going beyond the static "Days Beyond Terms" metric, the "Days Beyond Terms Trend" offers a dynamic view by plotting the DBT over time. By tracking this trend, you can identify if the company is improving its payment habits or if there's a consistent pattern of delay, helping in forecasting future payment behaviours. This is compared against the companies who are in the same industry.

Similarly, the Average Days Beyond Terms shows the average trend from the past year.

About Company

Company Identification Details

To know who you're doing business with, it's essential to have clear and accurate identification details. This section provides foundational information about the company. The report includes details such as the company's registered name, registration number, business type, establishment date, and registered office address.

Alert Notes

Staying informed about significant changes or events related to a company is crucial. The Alert Notes section displays pivotal updates or occurrences involving the company. By regularly monitoring these alerts, you can maintain an updated perspective on a company's status and potential risks.

View Purchased Credit Reports

- Open up the Customer

- Click on View Purchased Reports

- The list of purchased reports will show in date purchased order, with the most recently bought report at the top

View a Sample Credit Report

- Open up the Customer

- Click on Get Credit Report

- Review the details and click on the View a sample Credit Report link

- The sample report will show in a new tab allowing you to view what data you would get from purchasing a Credit Report on your Customer.